Challenge

How can a fund point out its positive impact to investors?

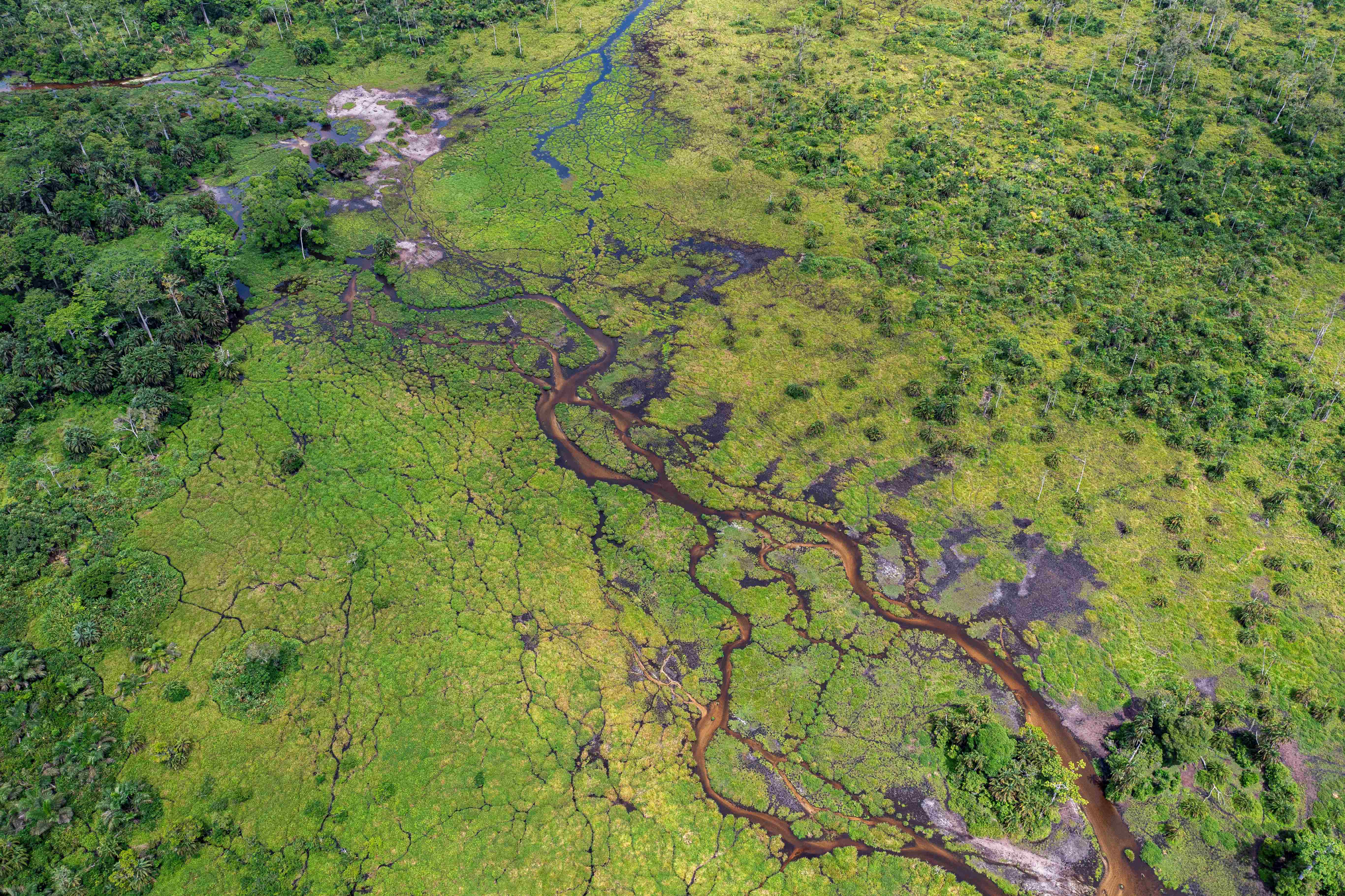

As countries across the globe seek to transition to Net Zero, there is a clear focus on building sustainable economies.

With an estimated market size of $715 billion and growing investor demand, impact investing helps fund this transition. Yet, risks of impact washing could hinder capital flow. As such, financial institutions need to be more transparent about the real impact, investments are making. Through robust and transparent reporting, the industry can build trust in these investments and encourage capital to flow into a sustainable economy.

Recognising this opportunity, WHEB Asset Management had already set up a dedicated tool with which investors could calculate the social and environmental impact of its multi-thematic sustainability fund. But to ensure its process was top of the line, WHEB sought an independent review of its impact measurement approach.

Solution

Creating transparency and consistency across WHEB’s impact reporting

Our experience in impact methodologies, alongside our understanding of data quality, placed us in a good position to review WHEB’s impact model.

To strengthen the integrity of any impact claims, it’s not just about sharing as much impact data as possible; it’s also about data quality. Since WHEB looked to hone its impact reporting, we helped them address one of the critical blockers financial institutions face in impact reporting: their reliance on receiving this data from portfolio companies. Together with WHEB’s sustainability team, we:

Impact

Adding an extra layer of integrity to impact data

Financial institutions have an opportunity to build credibility in their impact models, which will be indispensable if the industry wants to fund the solutions for climate mitigation and adaptation. This review allowed WHEB to back its commitment to sharing transparent impact data and be assured in its current approach. This project has given WHEB's reporting an extra level of credibility, so it can: