Sustainable finance

Turning the vision of a decarbonised future into reality not only requires a tremendous global effort, it also demands material increases in investment and financing. We have a 20-year track record of working with the financial sector, government and corporates globally to unlock the financial resources that can drive climate action at scale.

Wherever you are on your journey to Net Zero, we have the financial and technical expertise to help you leverage sustainable finance to accelerate.

What is sustainable finance?

How we can help

Climate action requires a holistic approach. We combine our experience of finance, emissions reductions and low carbon solutions to increase the flow of sustainable finance. In doing so, financial institutions can drive capital towards projects and activities that will deliver sustainable outcomes and impact. We work across two pillars:

Greening finance

Helping the financial sector identify, measure, understand and manage climate risks and opportunities, accelerating the green transition through implementation and action.

- Footprinting: Measure your operational and financed emissions in line with international standards and best practices. In the process, we verify your footprint and subsequent emissions reductions so you can track your progress with confidence.

- TCFD: Integrate climate risks and opportunities into your portfolios and investment assessments to support decision-making across your team.

- Target setting: Set ambitious and business-relevant science-based targets for both the short- and long-term, encouraging emissions reductions across your organisations and portfolios.

- Roadmaps and strategies: Develop strategies to support you on your decarbonisation and transition journeys, and help you deliver your targets.

Financing green

Helping clients create and leverage green financial products for climate action.

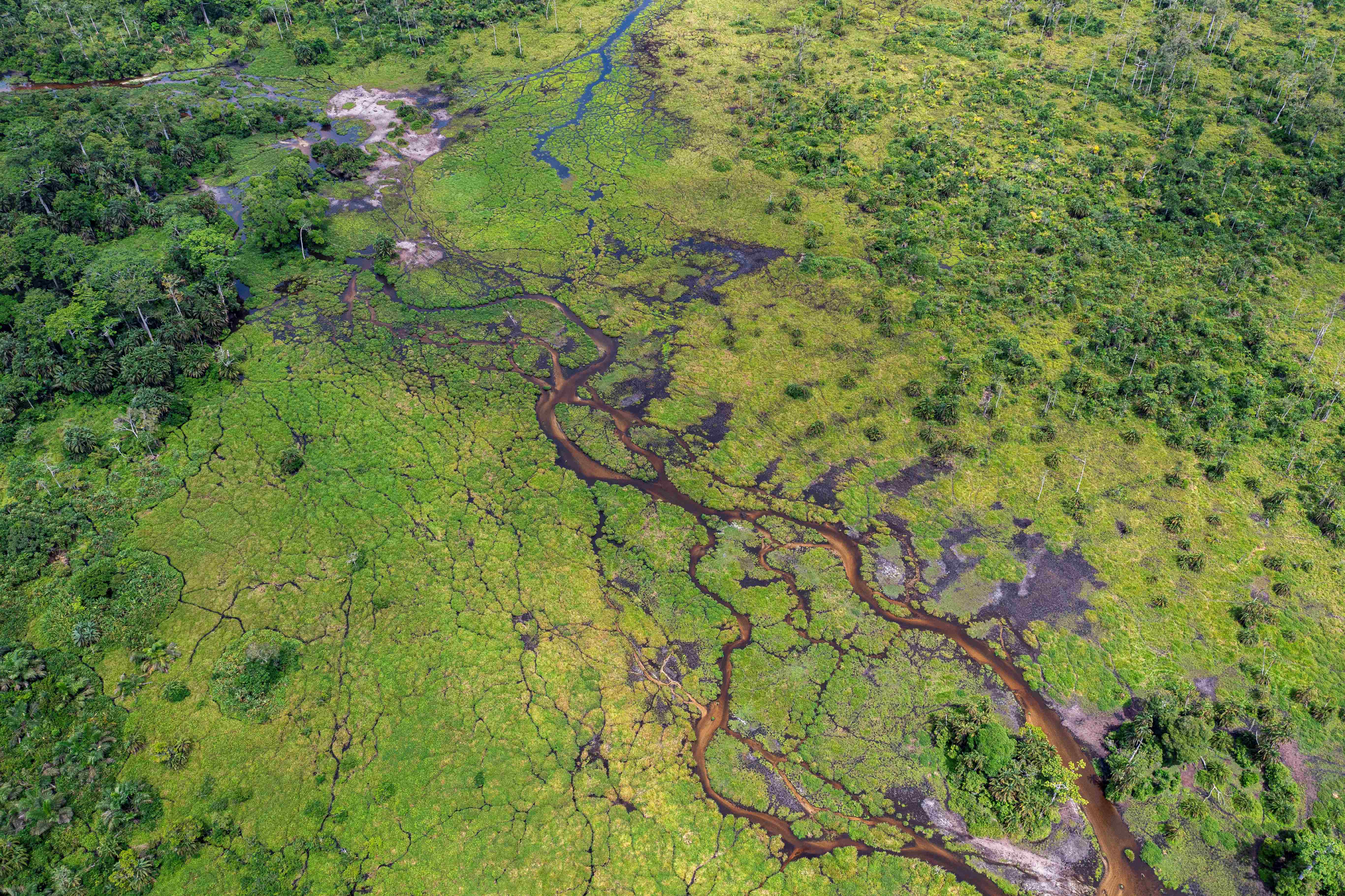

- Climate finance: Design and development of national or sub-national level financial mechanisms such as loans, guarantees or incentive schemes, to support the achievement of climate objectives

- Green taxonomies: Supporting the development of green taxonomies and advising on alignment of financial products and investments

- Thematic bonds and loans: Advising on bond and loan frameworks for identifying eligible assets or accelerating decarbonisation

- Impact assessment: Developing methodologies to measure and communicate the climate impacts of bonds, loans, and funds

Why the Carbon Trust?

We understand that finance cuts across the breadth of climate mitigation and adaptation action as a key enabler.

In response, our sustainable finance team is integrated across the Carbon Trust’s activities, leveraging geographical, sectoral and solutions-focused specialisms to mobilise the best experts for the challenge at hand. Our team has a proven track record providing expertise to the financial sector (both private and public), government, corporate and philanthropic institutions around the world.

In practice

Our sustainable finance experts

-

Pietro Rocco

Head of Sustainable Finance

-

Carolina Descio

Senior Manager, Sustainable Finance

-

Toby Kwan

Senior Manager, Sustainable Finance

-

Arturo Palacios Brun

Deputy Director Mexico, and Head of Sustainable Finance, Latin America

-

Hilda Sin

Senior Manager, Sustainable Finance (Asia)

-

Renata Lawton-Misra

Co-Head of Africa, Employee Director